Brazil stands as a cornerstone of the Latin American healthcare market, but healthcare needs amongst its sizable population are evolving due to demographic shifts, an expanding middle class, and an increase in chronic diseases. Whilst the country is already a major player in its region, often acting as a healthcare hub for neighbouring nations, there’s increasing demand for improved healthcare services and advanced medical technologies.

Having undergone significant healthcare sector reform – with private and public partnerships contributing to growth in medical facilities and healthcare access, the Brazilian medical device and IVD market is becoming progressively more lucrative for international manufacturers.

The central regulatory authority, the Agência Nacional de Vigilância Sanitária (ANVISA) aims to safeguard public health through rigorous compliance measures while fostering innovation and accessibility to medical technologies. As Brazil continues to expand its role in the global medical device and IVD market, its regulatory framework remains a critical pillar in maintaining high standards of safety and quality for both local and international manufacturers. Understanding the regulatory landscape and overcoming its challenges enables manufacturers to navigate Brazil’s unique regulatory complexities and ultimately capitalise on the market opportunities.

Below, in the first of four topical articles on fast-growing markets, our Head of Regulatory Bruno Gretler shares an overview of Brazil’s regulatory landscape for medical devices and IVDs, covering classification, market access pathways, post-market surveillance, and strategies to overcome the key challenges.

An overview of the Brazilian regulatory framework

The Brazilian government aims to improve healthcare access and infrastructure through its public health system, SUS (Sistema Único de Saúde), with the central regulatory authority ANVISA operating under the Ministry of Health.

ANVISA’s role extends beyond product approval, encompassing post-market surveillance, compliance enforcement, and GMP certification for high-risk products. Brazil’s regulatory framework is structured to support both local manufacturers and international companies, facilitating market access while maintaining stringent regulatory integrity.

The framework is built upon progressive legislation, continuously evolving to align with medical advancements and international best practices. Foundational laws such as Law No. 6360/1976 established the need for regulatory oversight, while recent updates, including RDC 751/2022, RDC 830/2023, and RDC 848/2024, have modernised requirements:

- RDC 751/2022 has overhauled device classification, risk assessment, and approval pathways, providing greater regulatory clarity

- RDC 830/2023, effective since 1 June 2024, introduces revised classification rules and post-market requirements for IVDs, ensuring a risk-based approach to safety and effectiveness

- RDC 848/2024, effective since 4 September 2024, defines essential safety and performance criteria, bringing Brazil closer to international harmonization, particularly with the International Medical Device Regulators Forum (IMDRF)

How are medical devices classified in Brazil?

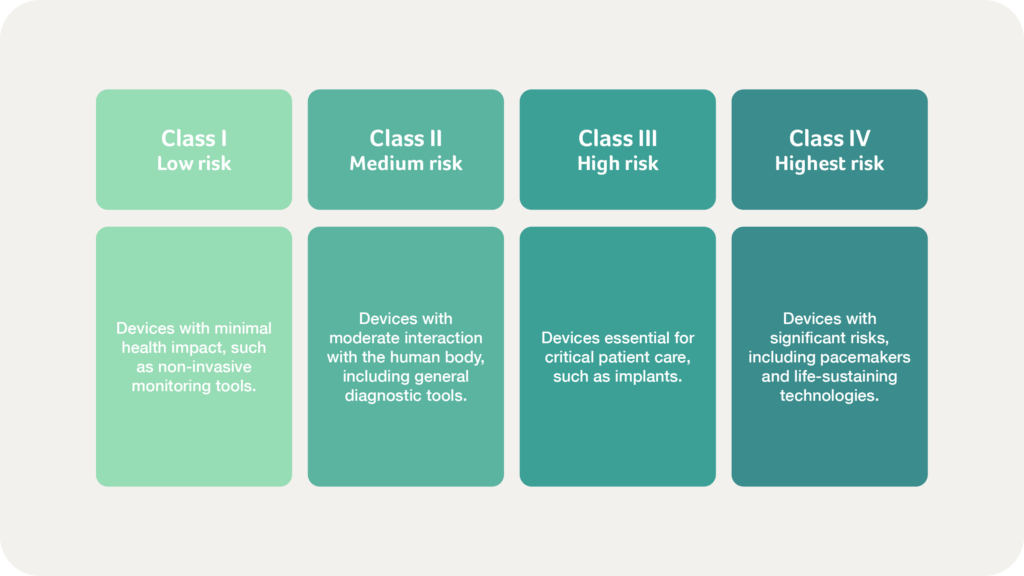

ANVISA employs a risk-based classification system, aligning with international regulatory frameworks such as the EU MDR and IMDRF. Medical devices are categorised into four risk classes:

Certain medical devices, particularly electrical medical equipment, require additional INMETRO certification, which mandates laboratory testing, factory inspections, and ongoing compliance assessments to ensure national safety and performance standards. Manufacturers must carefully evaluate their products to determine the appropriate classification, as this directly impacts documentation and testing requirements.

How are IVDs classified in Brazil?

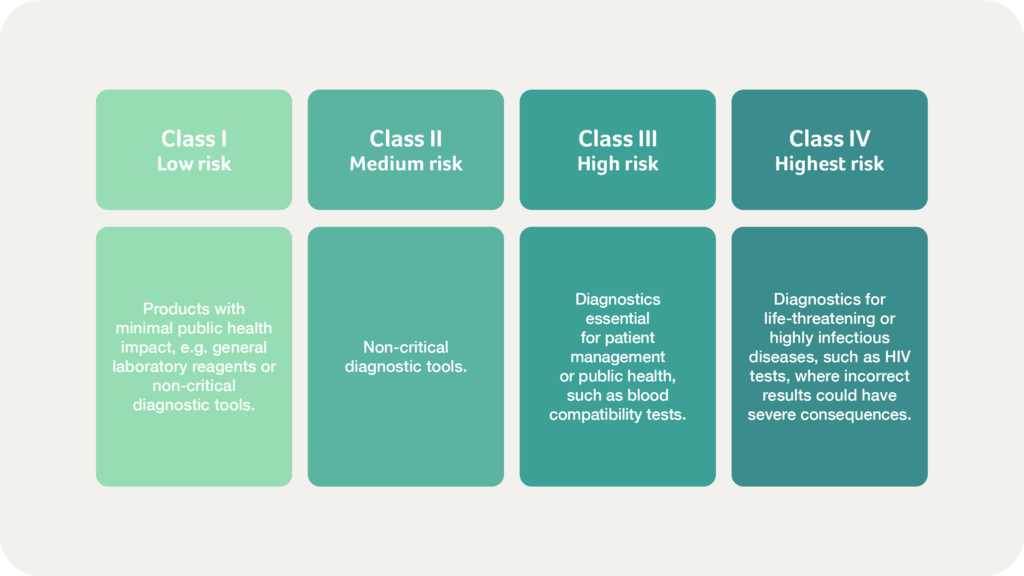

The classification of in vitro diagnostic products follows a similarly structured, risk-based model but incorporates additional criteria specific to the nature of diagnostic testing. RDC 830/2023 introduced significant changes in the classification and regulatory requirements for IVDs, emphasising performance, safety, and post-market vigilance, ensuring that diagnostic products meet the highest standards throughout their lifecycle.

IVDs are categorised based on their intended purpose, the health risks associated with incorrect results, and the type of condition being diagnosed. ANVISA evaluates whether the test is used for screening, diagnosis, or patient monitoring and considers the severity of the condition the test addresses:

What does the Brazilian market pathway for medical devices & IVDs involve?

Brazil has streamlined its medical device and IVD registration process, particularly for higher-risk Class III and IV devices, through a new Reliance Regulatory Framework. This framework, detailed in Normative Instruction (IN) 290/2024, effective since 3 June 2024, expedites market access for products already approved by recognised foreign regulatory authorities (AREEs) such as the FDA, Health Canada, TGA, and Japan’s PMDA.

By leveraging existing AREE assessments, ANVISA reduces time to market via an abbreviated analysis for devices and IVDs subject to the Registro process. Manufacturers seeking this expedited pathway must submit comprehensive documentation, including proof of AREE approval, a declaration of conformity, and compliant instructions for use. This initiative not only accelerates access to innovative technologies but also enhances ANVISA’s regulatory efficiency and promotes international harmonization.

The broader pathway to market for medical devices and IVDs in Brazil, overseen by ANVISA, begins with international manufacturers appointing a Brazilian Registration Holder (BRH) to manage compliance and serve as their liaison with the agency.

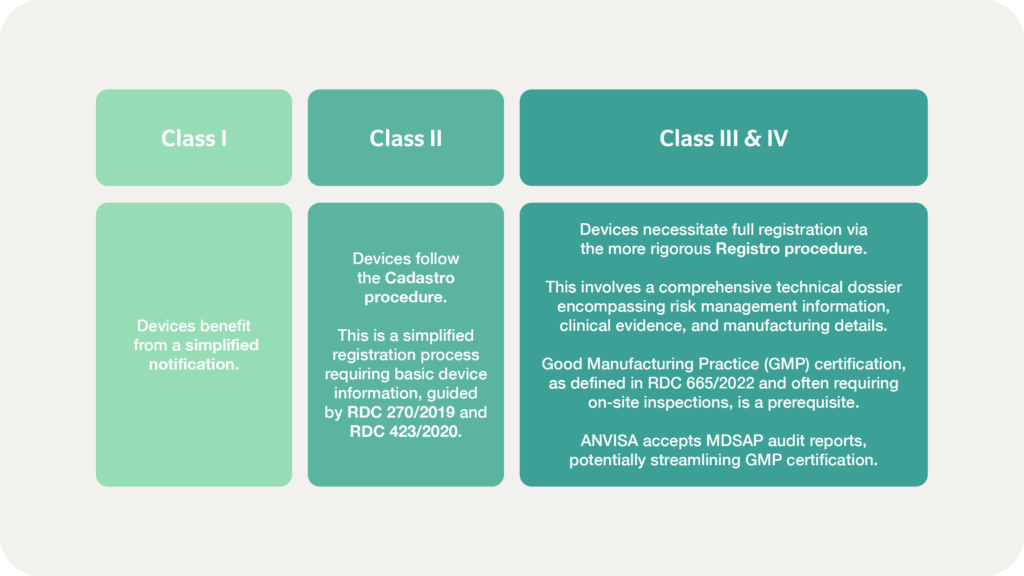

Device classification dictates the registration route:

Following dossier submission, ANVISA conducts a thorough review of safety, efficacy, and compliance. While low-risk device approvals may be granted within weeks, Class III and IV products may require several months or more, with manufacturers often needing to address additional data requests.

Market authorisation, once granted, is valid for five years, requiring renewal applications demonstrating continued compliance.

What post-market requirements should be considered for the Brazilian market?

Successfully entering the Brazilian market is only the beginning of the journey. ANVISA places significant emphasis on post-market surveillance, requiring manufacturers to establish systems that facilitate the reporting of adverse events, the implementation of Field Safety Corrective Actions (FSCA), and the renewal of product registrations every five years.

Maintaining robust post-market systems is essential to ensuring compliance throughout the product lifecycle and protecting patient safety. Serious incidents, particularly those involving patient harm, must be reported within strict timelines, with immediate threats requiring notification within 10 calendar days. Additionally, FSCA including recalls or labelling updates, must be promptly communicated to ANVISA.

What are the challenges unique to the Brazilian regulatory landscape?

Despite its opportunities, Brazil’s regulatory landscape presents challenges that require careful navigation:

Regulatory complexity

One of the primary challenges lies in the complexity of Brazil’s regulatory requirements. As mentioned above, ANVISA’s framework is built around a risk-based classification system for both medical devices and IVDs. While this structure is harmonized with international standards, the interpretation and application of these regulations often differ, requiring localised expertise.

For higher-risk products, the submission process demands comprehensive technical documentation, including clinical data and risk management reports, which can be resource-intensive.

Brazil’s regulatory landscape is also highly dynamic, with frequent updates such as the introduction of RDC 830/2023, which has imposed new requirements for IVD products. Staying informed of these changes and adapting to evolving requirements can be a daunting task for manufacturers.

Time-consuming requirements

Another significant hurdle is compliance with Good Manufacturing Practices (GMP), particularly for Class III and IV devices. ANVISA’s GMP certification process requires on-site inspections of manufacturing facilities, which can lead to delays due to logistical challenges and limited inspection availability. For foreign manufacturers, this step often involves coordinating with Brazilian regulatory officials, which adds another layer of complexity.

Challenges in post-market compliance also often stem from the vigilance system’s stringent timelines.

Language barriers

Language barriers also pose a challenge, as all regulatory submissions, technical documentation, and post-market reports must be prepared in Portuguese. Even minor translation errors can lead to significant delays or rejections.

Tax & customs regulations

Market entry can also be hindered by Brazil’s unique tax and customs regulations. Import duties and complex procedures for product clearance at customs can often increase costs and cause delays. Moreover, the country’s preference for locally manufactured products can create competitive disadvantages for foreign companies, particularly those without a strong local presence.

How to overcome the regulatory challenges in Brazil

To help overcome these challenges effectively, manufacturers must adopt a proactive and strategic approach:

Choose an experienced BRH

Partnering with a reliable Brazilian Registration Holder (BRH) is often the first and most crucial step for foreign manufacturers. The BRH serves as the legal representative in Brazil, managing all regulatory submissions and ensuring compliance with local requirements. Choosing a BRH with proven expertise and a strong track record can streamline the regulatory process significantly.

Invest in pre-market preparation

Investment in thorough pre-market preparation is another essential strategy. Manufacturers should ensure that their technical dossiers are complete, accurate, and tailored to meet ANVISA’s specific requirements. For higher-risk products requiring GMP certification, early planning and coordination with ANVISA can help mitigate delays. Working with regulatory consultants experienced in GMP compliance can also improve readiness for on-site inspections.

Prioritise professional translation

To address language barriers, manufacturers should have all regulatory documents professionally translated. Engaging translators with expertise in medical and technical terminology will help to prevent errors that could otherwise lead to rejections or delays.

Monitor regulatory updates

Staying informed of regulatory updates is critical, particularly considering the evolving requirements such as those introduced by RDC 830/2023. ANVISA’s digital transformation initiatives, which are expected to streamline submissions, should also be a focus.

Manufacturers should establish systems to monitor changes in ANVISA’s regulations and participate in industry forums or associations to stay ahead of developments. Building relationships with local regulatory experts can also provide valuable insights and support for adapting to new requirements.

Collaborate with local partners

For foreign manufacturers seeking to mitigate the challenges posed by Brazil’s tax and customs environment, establishing partnerships with local distributors or considering partial local manufacturing can be advantageous. These strategies not only reduce import-related delays but also enhance market competitiveness by aligning with Brazil’s preference for locally produced goods.

Assign a dedicated post-market team

Proactive regulatory engagement, robust internal surveillance systems, and collaboration with experienced Brazilian regulatory consultants can help manufacturers meet Brazil’s post-market obligations effectively. Establishing a dedicated team to handle post-market surveillance can help streamline this process and ensure timely responses to regulatory requirements.

In conclusion…

Brazil’s regulatory framework for medical devices and IVDs is a dynamic and evolving system designed to ensure patient safety while fostering innovation. By understanding the classification system, preparing for market entry challenges, and maintaining robust post-market compliance, manufacturers can successfully establish themselves in this expanding market.

ANVISA’s emphasis on alignment with international standards reinforces Brazil’s role as a key destination for medical technology companies. With strategic planning, regulatory diligence, and engagement with local expertise, manufacturers can navigate the complexities of the Brazilian market and capitalise on its growing opportunities.

Are you looking to register your medical device in Brazil? Our Regulatory team is ready to help – simply get in touch to start the conversation.

Our fast-growing markets series continues…

Stay tuned over the coming weeks for parts 2, 3, and 4 of our fast-growing markets series, which will explore the regulatory landscapes for Mexico, India, and South Africa.