Mexico’s population is 126 million – and counting. As healthcare becomes increasingly affordable and accessible to the country’s growing population, the Mexican market’s desirability as a strategic location for medical device manufacturers is progressing in parallel.

Domestically, Mexico’s expanding middle class is prompting greater demand for improved treatment and products as more people can afford health insurance or private healthcare. Initiatives like the “Seguro Popular” program has also expanded health coverage to millions of previously uninsured citizens. Improved healthcare infrastructure including modernised facilities has further fostered market growth, whilst digital health advancements in telemedicine and electronic health records have created new business opportunities in the sector.

Internationally, Mexico is a popular destination for medical tourism, particularly for procedures like dental work, cosmetic surgery, and affordable healthcare for Americans and Canadians. Its proximity to the US and its participation in trade agreements like the USMCA (formerly NAFTA) also make it an attractive location for global medical companies to establish manufacturing, research, and development facilities.

The healthcare sector in Mexico is governed by a structured regulatory framework overseen by the Comisión Federal para la Protección contra Riesgos Sanitarios (COFEPRIS). Functioning under the Ministry of Health, COFEPRIS ensures the safety, quality, and efficacy of medical devices and in vitro diagnostics (IVDs) through a harmonized system rooted in the General Health Law and the Reglamento de Insumos para la Salud. These regulations establish clear pathways for the registration, importation, and commercialisation of these products while aligning with international standards.

For medical device manufacturers who wish to access the Mexican market, understanding the country’s regulatory framework is essential for ensuring successful product registration and market approval.

Below, in the second of four topical articles on fast-growing markets, our Head of Regulatory Bruno Gretler shares a useful overview of Mexico’s regulatory landscape for medical devices and IVDs, covering classification, market access pathways, post-market surveillance, and strategies to overcome the key challenges.

An overview of the Mexican regulatory framework

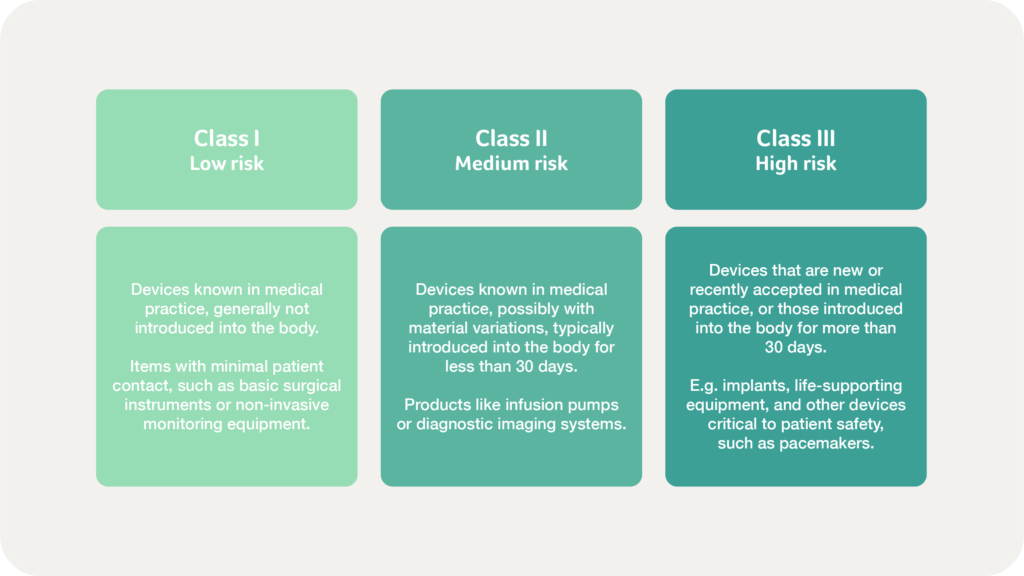

Medical devices and IVDs in Mexico are classified based on their risk level and intended use, ranging from low-risk Class I to high-risk Class III. The classification dictates the regulatory pathway and documentation requirements, including potential in-country testing for certain high-risk products.

While COFEPRIS recognises the ISO 13485 certification without requiring additional audits, foreign manufacturers must still appoint a local authorised representative or Mexican Registration Holder (MRH) to manage submissions and post-market obligations. This requirement emphasises the importance of local compliance and the necessity of working with a trusted regulatory partner to ensure smooth interactions with the authorities.

Approval processes vary by risk classification, with expedited pathways available for low-risk devices. High-risk devices and IVDs require more extensive evaluations, including technical reviews, clinical data, and local performance testing in some cases. While approval timelines range from a few months for Class I devices to over a year for Class III products, Mexico’s regulatory framework offers an equivalency route. This option accelerates approval for devices approved in highly regulated markets such as the US, Canada, and Japan, provided they meet COFEPRIS requirements. Leveraging approvals from other international regulatory agencies can significantly reduce time to market, but manufacturers must ensure that all documentation aligns with Mexican requirements.

How are medical devices classified in Mexico?

Mexico’s regulatory system adheres to international classification principles, ensuring both product safety and global trade compatibility. The classification is based on intended purpose, duration of interaction with the human body, and the degree of invasiveness.

Proper classification is crucial, as it determines the required regulatory pathway and documentation, the complexity of the approval process, the level of regulatory scrutiny, and approval timelines.

Medical devices in Mexico are categorised into six functional groups:

- Medical equipment

- Prosthetics, orthotics, and functional aids

- In vitro diagnostics (IVDs)

- Dental supplies

- Surgical and dressing materials

- Hygiene products including software as a medical device (SaMD)

Once categorised, devices are then further classified into three tiers of increasing risk, to ensure that products undergo the appropriate level of review – balancing market access with patient safety. As risk increases, COFEPRIS imposes stricter pre- and post-market regulatory requirements to safeguard public health:

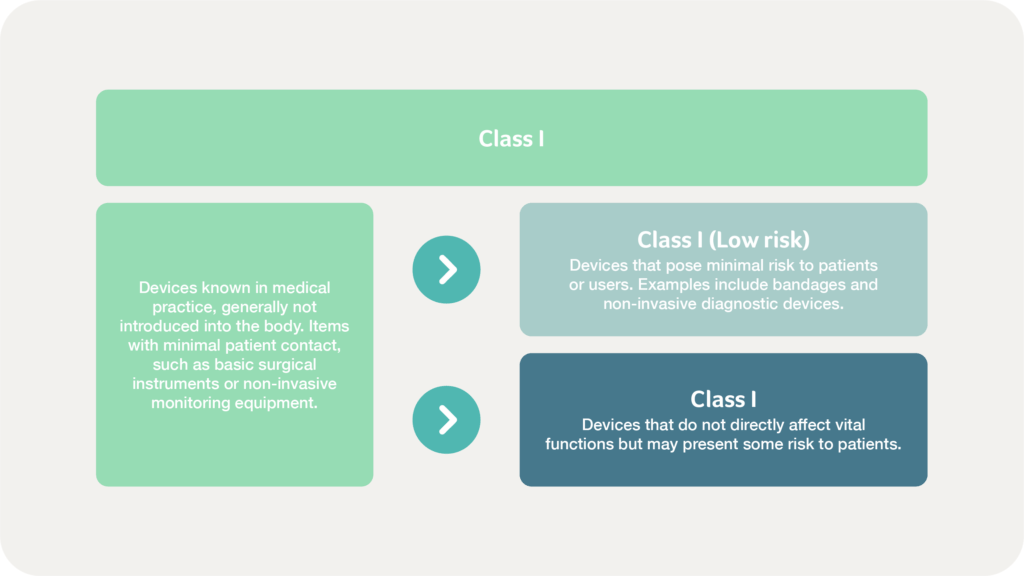

Mexico’s classification system also includes a distinction within Class I devices to align with international standards and provide clarity on the varying risk levels within Class I devices. According to the Supplement of Medical Devices of the Mexican Pharmacopoeia, there are two subcategories as demonstrated below:

Significant regulatory updates

COFEPRIS introduced significant regulatory updates with the release of Edition 5.0 of the Supplement of Medical Devices of the Mexican Pharmacopoeia, which became official on 10 July 2023.

A key update was the official recognition of Software as a Medical Device (SaMD), classified under Rule 16 in Appendix II, assigning software into Class I, II, or III based on risk. Additionally, Appendix X outlines specific regulatory requirements for software developers and manufacturers, providing a structured framework for compliance.

Grouping devices

Grouping similar devices under the same registration reduces regulatory burden. However, they must meet COFEPRIS criteria, such as being manufactured by the same entity, serving the same function, and sharing a commercial designation. This process can simplify registration and reduce costs, making it an attractive option for manufacturers with product portfolios that include similar devices.

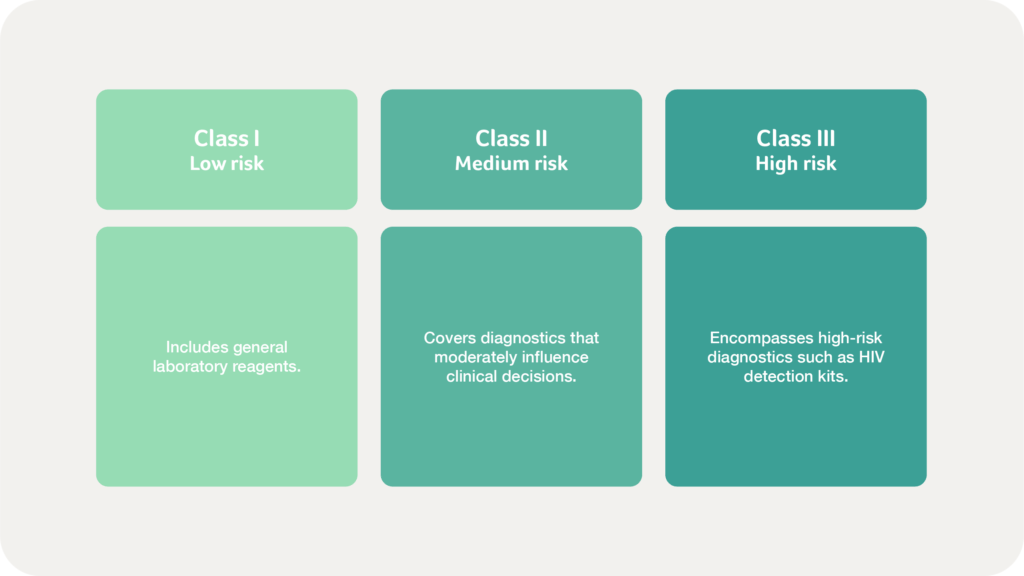

How are IVDs classified in Mexico?

IVDs are regulated separately and categorised based on risk levels:

Significant regulatory updates

As part of the release of Edition 5.0 of the Pharmacopoeia as mentioned above, IVD classification rules were also revised and expanded to align with global regulatory trends. Notably, SARS-CoV-2 detection kits, allergen tests, and self-diagnostic tools now have explicit classification guidelines.

What does the Mexican market pathway for medical devices & IVDs involve?

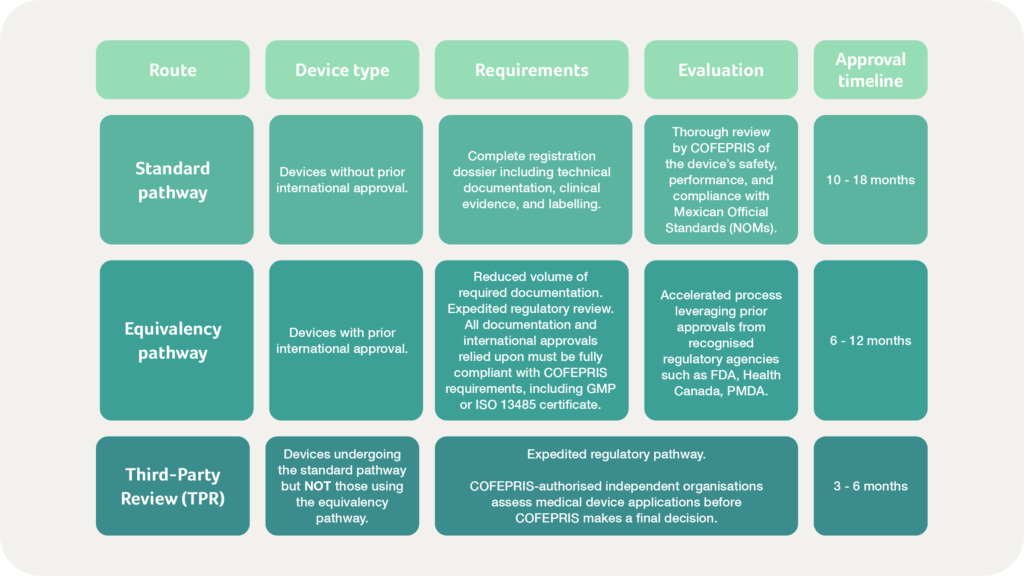

To obtain market access in Mexico, manufacturers must follow one of three regulatory routes:

- The Standard pathway

- The Equivalency pathway or

- The Third-Party Review (TPR)

Evaluating the TPR route

TPRs streamline interactions, helping resolve issues more quickly than the standard or equivalency pathways. However, there are additional costs, with extra fees ranging from $2,000 to $4,000 USD. Furthermore, TPRs do not guarantee approval – COFEPRIS retains the final decision-making authority. As such, while the TPR route speeds up registration, manufacturers must weigh the cost-benefit ratio and ensure full compliance before submission.

Appointing a Mexican Registration Holder (MRH)

Foreign manufacturers must appoint a Mexican Registration Holder (MRH), who serves as the primary liaison with COFEPRIS and ensures compliance with all regulatory requirements. The cost of registration varies based on product classification and regulatory route, typically ranging from $5,000 to $10,000 USD, excluding additional testing or certification expenses.

The impact of deficiency letters

If COFEPRIS issues a deficiency letter, manufacturers should anticipate an additional six to eight months for resolution. The best-case scenario for registration is six months, whereas a worst-case scenario involving a deficiency letter could extend the process to 26 months.

What post-market requirements should be considered for the Mexican market?

Obtaining Sanitary Registration from COFEPRIS is only the first step in legally selling a medical device or IVD in Mexico. Post-market compliance remains essential, requiring continuous regulatory oversight.

The appointed Mexican Registration Holder (MRH) plays a central role in maintaining compliance, as only legal residents can interact directly with COFEPRIS. An experienced MRH should facilitate communication with authorities, manage official processes, and ensure necessary documentation remains up to date. The MRH is responsible for:

- Securing and maintaining valid import licenses

- Managing modifications and renewals of Sanitary Registration

- Implementing a robust technovigilance system

Renewing an import license

Import licenses are typically valid for up to 180 days or for a specified quantity of devices. Timely renewal is essential to prevent distribution disruptions. The MRH plays a pivotal role in managing these licenses and ensuring compliance with importation regulations.

Renewing a device registration

Timely registration renewals, required every five years, are crucial to maintaining market access. Failure to renew on time can result in product withdrawal, underscoring the importance of careful regulatory planning.

Renewals, also known as extensions, must be initiated through a digital application process. The first renewal should be submitted at least 150 days before the expiration of the existing registration and must include key documentation such as an application fee, Power of Attorney, technovigilance report, representation letter, and GMP certification or its equivalent, such as an ISO 13485 certificate. The initial renewal process is more time-intensive, while subsequent renewals require fewer administrative steps.

Implementing a technovigilance system

Mexico’s vigilance system requires manufacturers to track product safety and implement corrective and preventive actions (CAPA) when necessary. Establishing a technovigilance system enables continuous monitoring of device safety and effectiveness throughout its lifecycle.

Technovigilance involves maintaining a dedicated unit responsible for monitoring adverse events and ensuring compliance with NOM-240. This unit must be operated by personnel experienced in technovigilance processes. A technovigilance report summarising incidents, investigations, and corrective measures is required as part of COFEPRIS registration renewals.

The MRH oversees adverse event reporting to the National Centre of Pharmacovigilance (CNFV). While not all incidents require formal reporting to COFEPRIS, manufacturers must maintain detailed records of their findings and corrective actions, even for cases where external reporting is not mandatory. Serious adverse events must be reported within defined timeframes to prevent penalties or loss of market authorisation.

What are the challenges unique to the Mexican regulatory landscape?

A rigorous & evolving regulatory framework

One of the main challenges is adhering to COFEPRIS’s rigorous regulatory framework. Misclassification or incomplete submissions can cause delays or rejections, making meticulous regulatory preparation essential.

Mexico’s regulatory landscape is also continuously evolving, requiring manufacturers to stay informed about updates aligning with international standards.

Language barriers

Language barriers add complexity, as all regulatory documentation must be in Spanish. Additionally, manufacturers must obtain a Certificate of Free Sale (CFS) from the product’s country of origin to verify that the device is legally marketed elsewhere.

Post-market requirements

Mexico’s strict post-market surveillance requirements now necessitate robust monitoring mechanisms to track product performance and safety. Non-compliance can result in penalties, recalls, or market authorisation loss, making regulatory vigilance a priority.

Customs & import logistics

Logistical challenges related to customs and importation processes can also delay market entry. Mexico’s classification and clearance procedures are complex, potentially increasing costs and delaying product launches.

Additionally, local preference for domestically manufactured products can create obstacles for foreign companies without local manufacturing or distribution networks.

How to overcome the regulatory challenges in Mexico

Prioritise pre-market preparation

Comprehensive pre-market preparation is essential. Manufacturers should conduct a detailed review of COFEPRIS regulations and tailor their submissions accordingly. While international certifications such as FDA approvals or CE markings can facilitate approval, they do not replace compliance with Mexico’s specific regulatory requirements.

Stay engaged

By regularly engaging with COFEPRIS and participating in industry discussions, manufacturers can stay informed about regulatory changes and best practices. Manufacturers should invest in compliance infrastructure, train personnel on evolving regulations, and leverage local expertise to strengthen their ability to navigate Mexico’s regulatory landscape effectively.

Employ professional translators

Addressing language challenges by employing professional translators specialising in medical and technical terminology will help to prevent errors and avoid delays.

Collaborate with local representatives

Selecting a competent MRH is vital, but partnering with local representatives and distributors with a deep knowledge of COFEPRIS requirements can also help to manage compliance obligations and overcome challenges with customs and importation. Collaboration with local experts will facilitate precise product classification, thorough documentation, and regulatory compliance.

Manufacturers may also consider local assembly or production to enhance competitiveness by reducing importation complexities and aligning with local market preferences.

In conclusion…

Mexico offers a significant market for medical devices and IVDs, governed by COFEPRIS’s structured regulatory framework. Market access requires comprehensive planning, compliance with classification rules, and adherence to submission and surveillance requirements. While international certifications can expedite approval, they do not replace local regulatory obligations.

Foreign manufacturers must appoint a Mexican Registration Holder (MRH) to manage compliance and regulatory interactions. And post-market surveillance, including robust technovigilance systems, is essential to maintaining market authorisation and addressing safety concerns.

Mexico’s medical device and IVD market offers substantial opportunities, but successful market entry and compliance require a strategic, well-informed approach to navigating challenges such as language barriers, evolving regulations, and logistical complexities. By ensuring thorough regulatory preparation, building strong partnerships with local experts, and staying updated with compliance requirements, manufacturers can effectively navigate Mexico’s regulatory landscape and achieve long-term success in this dynamic healthcare market.

Are you looking to register your medical device in Mexico? Our Regulatory team is ready to help – simply get in touch to start the conversation.

Our fast-growing markets series continues…

Stay tuned over the coming weeks for parts three and four of our fast-growing markets series, which will explore the regulatory landscapes for India and South Africa.